A primary goal of most married couples when contemplating basic estate planning documents is to ensure that the surviving spouse, and commonly, the couple's children and grandchildren, are supported financially.

Permissible estate tax avoidance and mitigation are central considerations in achieving financial security for surviving spouses and families. This article summarizes the applicable estate tax law to consider when implementing a basic estate plan and addresses the primary estate tax mitigation options that a married couple should consider. Because North Carolina repealed its inheritance tax in 2013, this article addresses only federal estate tax law, as it applies to citizens of the United States.

Estate Tax Primer

Unlimited Marital Deduction

Current law allows the first spouse to die to leave property of unlimited value to the surviving spouse without incurring any estate tax at the first spouse's death. This unlimited "marital deduction" insulates assets that will benefit and support the surviving spouse from estate tax. The assets can be distributed either by a direct transfer to the surviving spouse or by an indirect transfer to a qualifying trust for the surviving spouse's benefit. Couples may consider using a trust for asset protection, preservation of assets for children of a prior marriage, asset management assistance for the surviving spouse, or any number of other reasons. Regardless of whether the distribution is to the survivor or in trust for the surviving spouse's benefit, the marital deduction is a powerful estate tax avoidance tool for married couples.

The Estate Tax Exemption

The estate tax law is not quite as generous for non-spouse beneficiaries, although it has improved substantially in recent years. Legislation passed by Congress in 2013 allowed individuals to leave assets totaling $5,000,000 in value, indexed to inflation since 2011, to non-spouse, non-charitable beneficiaries. This estate tax benefit is generally known as the "estate tax exemption." Five years later, The Tax Cuts and Jobs Act effectively doubled the existing estate tax exemption amount, increasing it to $10,000,000 starting in 2018. But the law also incorporated an important provision that will operate to halve the exemption amount if additional legislation is not passed before the effective "sunset" date of January 1, 2026.

Bolstered by inflationary increases, now, in 2023, each spouse has an estate tax exemption of $12,920,000. Under the current unified gift and estate tax system, the exemption can be applied to cover gifts made during life, thereby exempting up to $12,920,000 of lifetime gift transfers from gift tax that would otherwise be imposed. However, the exemption amount available to a taxpayer's estate at death is reduced by the amount of the exemption used for lifetime gifts. Any value in a decedent's taxable estate that passes to a child (or another non-spouse family member) and exceeds the remaining amount of the decedent's exemption is subject to an estate tax rate of forty percent (40%).

While several proposals aiming to make the federal estate tax law less taxpayer-friendly have been offered by elected officials since 2018, none have cleared the legislative and political hurdles necessary to become law.

Portability

In 2013, Congress also made permanent the "portability" of a spouse's estate tax exemption. Portability allows a surviving spouse to capture and use the first deceased spouse's remaining estate tax exemption in addition to the surviving spouse's own exemption. However, in order to preserve the unused exemption, an estate tax return generally must be filed timely after the first spouse's death.

Estate Tax Mitigation Considerations For a Basic Estate Plan

Three primary estate tax mitigation plans are available to a married couple:

- All to spouse;

- Automatic; and,

- Disclaimer.

A fundamental understanding of how these different plans operate to address the estate tax is critical to developing a couple's basic estate plan.

"All to Spouse" Plan

An "all to spouse" plan leaves all (or substantially all) assets directly to, or in a qualifying marital trust for, the surviving spouse. The unlimited marital deduction prevents any estate tax from impacting the survivor. To preserve the portability of a deceased spouse's exemption, an estate tax return should be filed after the first spouse's death. Under current estate tax law, if Spouse A died in early 2023 and Spouse B dies later in 2023, Spouse B's estate would pass estate tax-free to the couple's children under Spouse B's estate tax exemption if the value of Spouse B's estate is $12,920,000 or less. If portability of Spouse A's exemption is preserved, then Spouse B's estate could leave up to $25,840,000 of assets estate tax-free to the couple's children and grandchildren. Because of the recent positive and substantial modifications to the estate tax law, the "all to spouse" plan, combined with portability, can now be a solid basic plan even for married couples with substantial assets. However, it is vitally important to consider the "sunset" provision contained in current law when deciding whether an "all to spouse" plan will be sufficient to address one's estate tax exposure.

"Automatic" Plan

If a married couple has a total estate that exceeds their available exemptions, then the "automatic" plan is an excellent one for estate tax reduction. This type of planning is sometimes called "credit shelter trust planning" or "optimal marital deduction planning." With this plan, a trust is established and funded with assets of the first spouse to die to make use of that spouse's estate tax exemption. The assets in the trust are available to the surviving spouse for life but are not included in the survivor's taxable estate at death. The surviving spouse even can be the trustee of the trust. Any appreciation on the assets in the trust from the time of funding until the survivor's death also avoids estate tax. Essentially, a trust "automatically" is established at the first spouse's death to accomplish two primary goals of the couple: first, benefit the surviving spouse and then, second, reduce any estate tax to maximize benefits for the couple's children and grandchildren.

An "automatic" plan also removes some potential risk associated with an "all to spouse" plan because future negative changes to the estate tax law could significantly undermine the estate tax benefits of an "all to spouse" plan. For example, if the estate of a surviving spouse relied solely on the availability of the predeceased spouse's $12,920,000 estate tax exemption and Congress reduces the estate tax exemption after the creation of the plan, the survivor's estate could face unexpected estate tax. Moreover, because the amount of the predeceased spouse's remaining estate tax exemption is a fixed number, relying on portability under an "all to spouse" plan does not avoid estate tax on appreciation. By contrast, the "automatic" plan avoids estate tax on post-death appreciation of those assets in the tax-advantaged trust, even over and above the exemption amount. An "automatic" estate tax plan can provide a hedge against future changes in the estate tax law or other risks of the "all to survivor" plan.

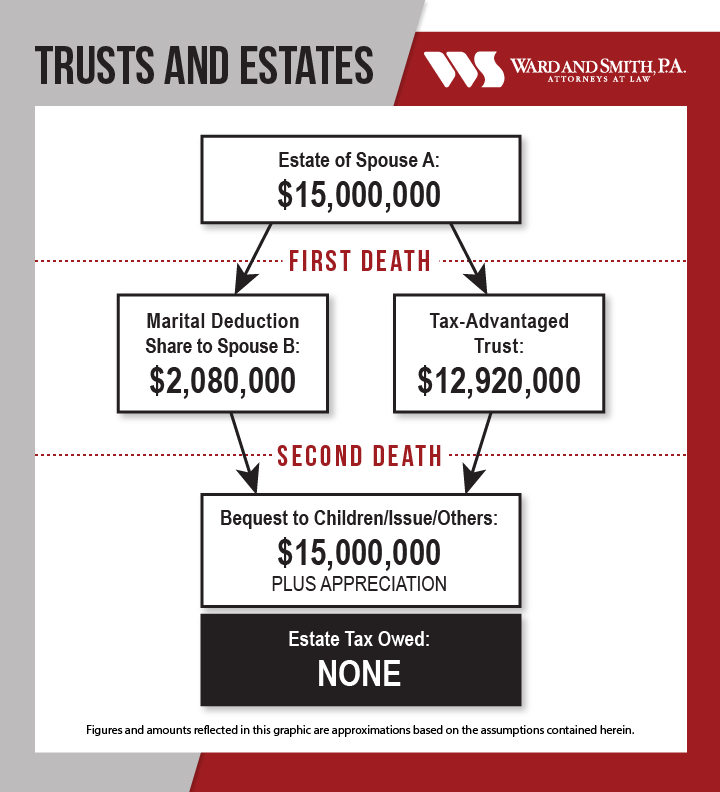

Illustration of "Automatic" Plan

The following basic illustration reflects how an "automatic" plan works to avoid estate tax on a $15,000,000 estate in 2023:

The Estate of Spouse A is divided after the first death into a Marital Share for Spouse B and a Tax-Advantaged Trust. The entire estate is passed to Children/Issue/Others at the second death. Under this illustration, no estate tax is owed.

"Disclaimer" Plan

Disclaimer is a legal tool that can be utilized to allow the survivor to move certain assets into a trust for the survivor's benefit (rather than receiving such assets directly), thereby using the deceased spouse's exemption. A "disclaimer" plan provides the best of both worlds. For married couples with a substantial estate that is less than their available estate tax exemptions, a "disclaimer" plan provides both the simplicity of an "all to spouse" plan and the option to implement a tax-advantaged trust similar to an "automatic" plan. The disclaimer approach leaves all assets to the survivor. Based upon the value of the first deceased spouse's estate, the then-existing estate tax law, and a variety of other factors, the survivor can choose within a reasonable amount of time after the first spouse's death to "disclaim" the first spouse's assets and divert them to a tax-advantaged trust.

Essentially, a "disclaimer" plan provides a "wait-and-see" opportunity to decide after the first death whether to rely at the survivor's death only on the survivor's exemption, file a portability return to preserve the exemption of the deceased spouse, fund a tax-advantaged trust, or some combination of these options. Flexibility abounds with this estate tax plan.

Conclusion

No "one-size-fits-all" approach exists for married couples who desire to take care of each other and mitigate estate taxes in order to maximize benefits for their children and grandchildren. Understanding the basic estate tax avoidance or mitigation tools available to a married couple is essential to the development of a basic estate plan. The application of these basic estate planning tools in a manner that takes the married couple's planning goals and estate values specifically into account ensures as best as possible that family benefits are maximized, and estate taxes are minimized, two very positive results of a well-considered estate plan.

Ward and Smith's trusts and estates attorneys offer extensive experience and knowledge in developing comprehensive estate plans. Our attorneys are here to assist married couples with the development of an individualized plan that meets their particular needs. Please contact us if you would like to discuss your particular circumstances and goals with one of our experienced estate planning attorneys.

--

© 2024 Ward and Smith, P.A. For further information regarding the issues described above, please contact .

This article is not intended to give, and should not be relied upon for, legal advice in any particular circumstance or fact situation. No action should be taken in reliance upon the information contained in this article without obtaining the advice of an attorney.

We are your established legal network with offices in Asheville, Greenville, New Bern, Raleigh, and Wilmington, NC.